My Robinhood Stock Picks for June 2018

This site utilizes Google Analytics, Google AdSense, as well as participates in affiliate partnerships with various companies including Amazon. Please view the privacy policy for more details.

At the end of last month - the last day, in fact - I signed up for a Robinhood account. I signed up mostly for fun - but also for the free stock that Robinhood is currently offering. I got Chesapeake Energy (CHK), which is worth only about five bucks. However, some people get stocks worth a couple hundred dollars, such as Facebook or Apple.

I have two rules for any money used to invest in stocks:

- This money is invested long-term - at a year, but probably longer. There will be no active trading or day trading.

- This money is money I can afford to lose - when I buy any stocks, I automatically assume a complete loss, at least as far as my budget goes.

As for purchasing stocks, I have come up with a few selection criteria:

- Stock price must be affordable - under $100, maybe even under $50. This is because Robinhood currently does not support buying fractional shares.

- The company must be a company I believe in - in terms of growth, ethics, technology, innovation, etc. So, no Wal-Mart, no tobacco companies, etc.

- There is a slight preference to companies I use.

I am by no means an expert at picking stocks or an oracle at determining their future price. Choose or don’t choose the same stocks as me at your own risk.

For each paycheck since I’ve opened the account I’ve bought at least one more “traditional” established stock, and one cheaper, riskier stock.

In June - plus on May 31 - I bought stock in the following companies:

- Plug Power

- Helios and Matheson Analytics Inc.

- Groupon

- Fitbit

- Ford

- General Electric

- GameStop

- Kroger

- Verizon

Kroger and Verizon fit the description of companies I use. I also occasionally shop at GameStop, as well as use Groupon. My wife actually wears a Fitbit. I don’t drive a Ford - I’m more a GM guy - but the stock was more affordable. Plug Power is an alternative power company.

That leaves General Electric (GE) and Helios and Matheson Analytics Inc. I’m not sure why I bought GE - I guess I just like the company. Helios and Matheson Analytics Inc. is the company behind MoviePass, and while it might not make sense now, I think MoviePass has potential - although that’s mostly a gut feeling.

Oh, the MoviePass company was the first stock I bought. Or rather, stocks - I bought 10 shares. For every other company, I only bought one share.

How have my stock picks fared? Check out the following table:

| Company | Symbol | Purchase Price | Current Value | $ Change | % Change |

|---|---|---|---|---|---|

| Plug Power | PLUG | $2.00 | $1.94 | $(0.06) | -3.00% |

| MoviePass | HMNY | $4.28 | $2.12 | $(2.16) | -50.47% |

| Groupon | GRPN | $4.40 | $4.20 | $(0.20) | -4.55% |

| Fitbit | FIT | $5.40 | $6.59 | $1.19 | 22.04% |

| Ford | F | $11.65 | $11.17 | $(0.48) | -4.12% |

| GE | GE | $14.00 | $13.87 | $(0.13) | -0.93% |

| GameStop | GME | $15.00 | $14.71 | $(0.29) | -1.93% |

| Kroger | KR | $24.40 | $28.70 | $4.30 | 17.62% |

| Verizon | VZ | $48.90 | $50.61 | $1.71 | 3.50% |

| Total | $130.03 | $133.91 | $3.88 | 2.98% |

Note that I changed Helios and Matheson Analytics Inc. to MoviePass in the table.

A month in, I’m in the green. Although that first stock I chose is doing rather poorly - MoviePass stock has dropped more than 50%. FitBit is doing the best with an increase of over 22%, closely followed by Kroger at almost 18%.

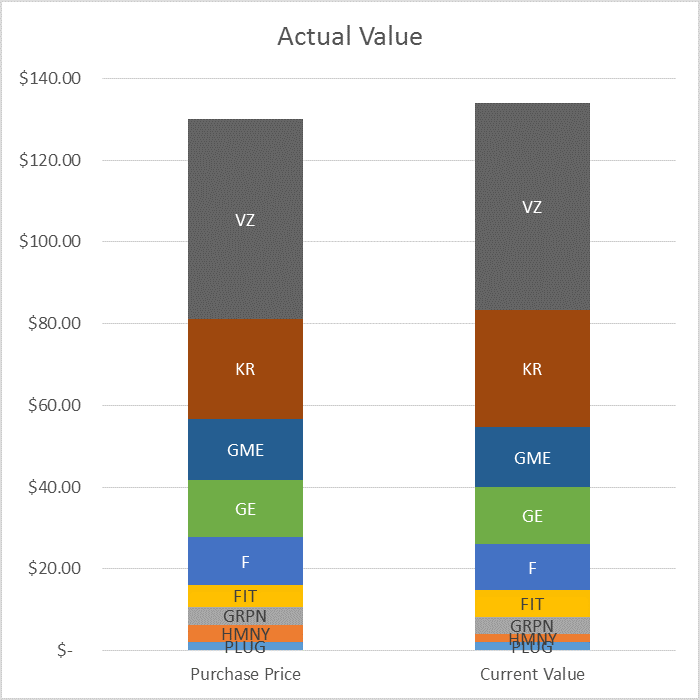

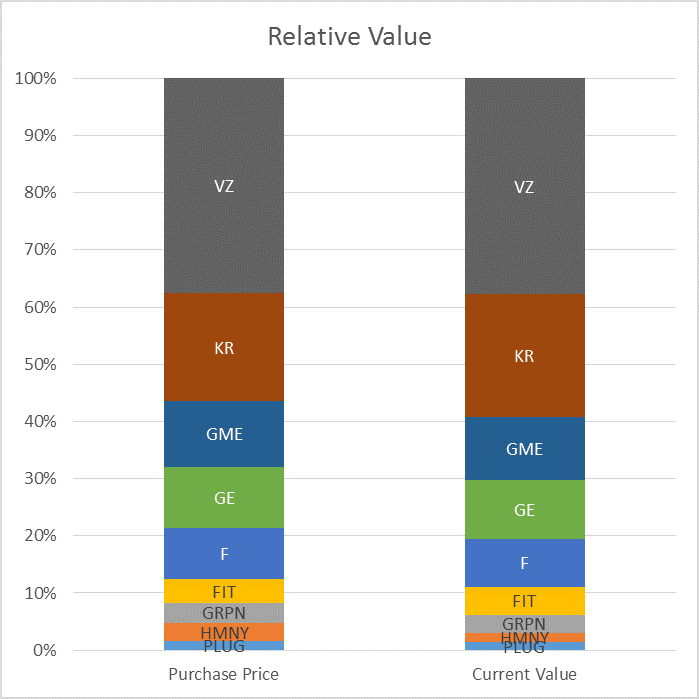

I made a couple of stacked bar charts to visualize the growth:

Actual Stock Value Chart

Actual Stock Value Chart

Relative Stock Value Chart

Relative Stock Value Chart

The Actual Stock Value Chart shows the growth of my entire portfolio - although, at slightly less than 3%, it’s hard to see. The other chart squishes both the purchase price and the current price into the same size, so you can see what percentage each stock took of my entire portfolio for both the purchase price and the current price. Again, it’s hard to make out the difference.

I’ve bought each stock at different dates and times, so the time frame between the purchase price and the current price is different for each stock. Since I’m doing this mostly for fun, it’s not that important.

Want your own free stock from Robinhood? Sign up using my Robinhood Referral link!

2 comments for My Robinhood Stock Picks for June 2018

Leave a Reply

i used to own about 35 thousand dollars of plug power stock and make some profit but will never own a crappy company like that again. here’s the article if you’re interested https://freddysmidlap.com/2017/10/18/my-17000-nap/

good luck with the investing.

freddy

I bought Plug Power because I thought it was a solar power company. I only bought one share at two bucks, though, and I plan on sticking with my buy-and-hold plan despite this.

Reply to This Thread