What Does a Credit Score Mean?

This site utilizes Google Analytics, Google AdSense, as well as participates in affiliate partnerships with various companies including Amazon. Please view the privacy policy for more details.

It’s the little three-digit number that people obsess over as if it’s the final grade in the school of life. It affects the interest rate of loans you may get - or even if you qualify for a loan in the first place. Nowadays, it can even affect things not normally associated with “credit” such as insurance and utilities.

It’s your credit score. But what does a credit score actually mean? What is it trying to measure?

What a Credit Score Does NOT Mean

There are a number of things people think a credit score measures:

- How successful you are in life.

- How good you are with money.

- How good you are with credit.

- How good you are with debt.

- How much money you make.

- How much money you have.

- How lucky you are with money.

- How much you love debt.

- How much you hate debt.

It’s true that these things may affect your credit score, but you could easily find two people who are opposite ends of the spectrum for any of them, yet have the same credit score. Conversely, you could find two people who are otherwise identical on one aspect, yet have opposite credit scores.

What a Credit Score Does Mean

When writing this article I did a quick Google search on the title. Google gave me a definition for credit score:

a number assigned to a person that indicates to lenders their capacity to repay a loan.

In other words, how likely you are to make debt payments in full and on time.

In particular, a credit score measures your capacity to repay a new loan at the moment the score is retrieved.

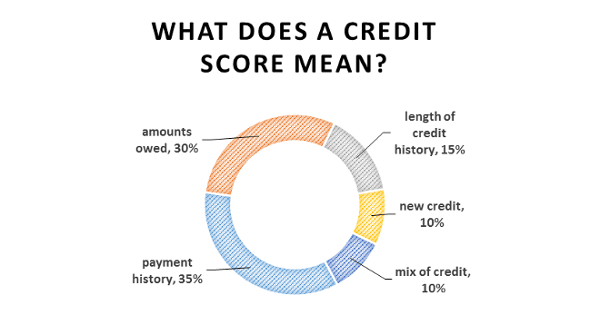

Let’s recap quickly to what makes up a credit score:

35%: Your payment history

30%: Amounts owed (how much of your total available credit you’re using at any one time)

15%: The length of your credit history

10%: New credit

10%: Mix of credit

The larger a percentage, the more that aspect affects your credit score. If there is a math equation (and I’m sure there’s some proprietary, non-public algorithm), it might look something like this:

35 * payment_history + 30 * amounts owed + 15 * credit_history_length + 10 * new_credit + 10 * credit_mix

It makes sense that payment history makes up the largest part of a credit score - it’s assumed that if someone has missed payments in the past, they’re likely to miss payments in the future.

Also, the more that is owed the greater risk. It’s assumed that the more someone owes, the more they’re extending themselves financially. Owe too much, that person might be overextending themselves and may be completely unable to make payments.

There are many reasons someone, through no fault of their own, may not be able to make payments. There are also plenty of reasons why someone may be at fault as to why they may not be able to make payments. The idea is, however, that a high score reflects a high likelihood of making every payment on-time, whereas a low score reflects a high chance of making late payments or even defaulting on the debt.

Your Credit Score is Not That Important.

Yes, your credit score is important, but it isn’t that important. In theory, just by not taking on more debt than is needed, and always paying on time, and anyone’s credit score should naturally improve. Never pay just to improve your score - whether it’s extra interest payments or some shady company that promises to get you a perfect score overnight.

Worry more about those financial items that you have more control of: increase your income, and decrease your expenses and debt.

Leave a Reply