Wright-Patt Credit Union Quietly Doubles TrueSaver Rate

This site utilizes Google Analytics, Google AdSense, as well as participates in affiliate partnerships with various companies including Amazon. Please view the privacy policy for more details.

Wright-Patt Credit Union (WPCU) members like me were pleasantly surprised to see that the amount they receive in their TrueSaver account had nearly doubled.

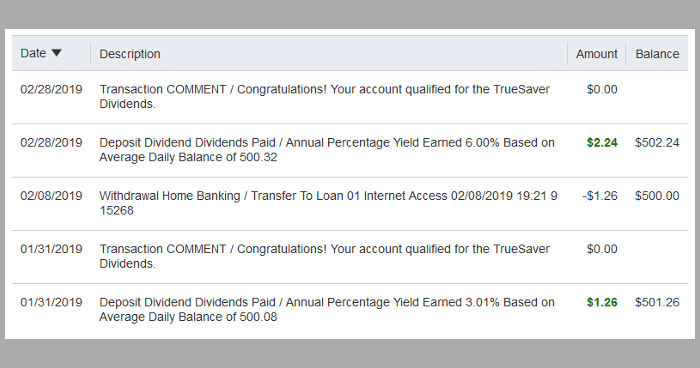

When I logged into my WPCU account today, I noticed that I received $2.24 in interest (Wright-Patt calls it “dividends”) instead of my normal $1.26:

My WPCU TrueSaver Dividend Doubling

My WPCU TrueSaver Dividend Doubling

The TrueSaver accounts used to have a rate of 3%. Now they have a rate of 6%.

The other conditions for a TrueSaver account remain the same:

- The special rate only applies to balances up to $500; a lower rate (0.15%) is applied to higher balances.

- The member must also have an active checking account with at least four eligible transactions a month. Eligible transactions include:

- Bill bay transactions

- ACH deposits and withdrawals

- Debit card transactions

- Point of sale transactions

- Cleared drafts

- There must be either regular direct deposits (at least once every 45 days) or be set up to receive eStatements

With online banks now having rates of high as 2.5% and climbing, I was beginning to worry that they would soon surpass WPCU’s TrueSaver rate. Now I can offset those worries.

Check out WPCU’s page on personal rates as well as their savings account disclosure PDF for more information.

Check out Doctor of Credit’s Best High Yield Savings Accounts page for, well, the best high yield savings accounts.

Leave a Reply