2021 Goal Check-In

This site utilizes Google Analytics, Google AdSense, as well as participates in affiliate partnerships with various companies including Amazon. Please view the privacy policy for more details.

2021 is more than half over - which makes this a good time to look at how far along I am at accomplishing my goals for this year.

The Goals I’m Missing

- Improve our parenting skills by either taking a parenting class (preferably) or reading a book

- Volunteer at church at least once

- Attend at least one marriage seminar or retreat

- Become 100% debt free

- Eat out no more than 1x week on average

- Reach a body fat percentage of 20% or lower

- Daily run to a 5-minute walk, 40-minute run, 5-minute walk

- Attend at least one conference

- Finish the fast.ai course

- Max out my bonus 5% grocery category with my new Chase Freedom Flex card.

I haven’t seen any parenting classes or marriage seminars available - hopefully, some will be available as the pandemic fizzles out.

I would be 100% debt-free, but I financed a Google Pixel 4a phone at 0% interest for the same cost a paying for it outright.

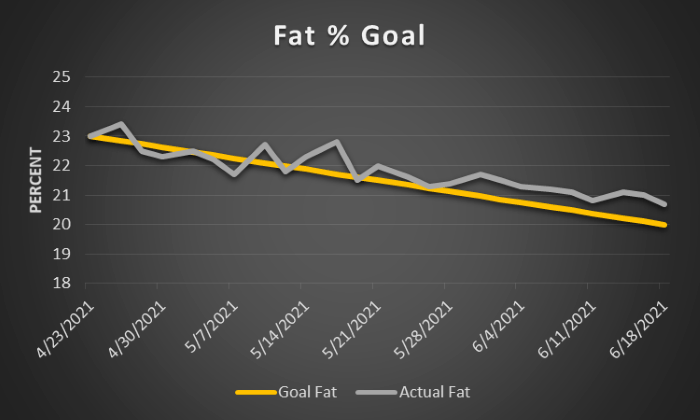

My body fat has stubbornly stayed around 21%. This morning I was at 21.5%. But look how close I got a month ago:

My fat percentage chart from April 23rd through June 18th

I’m starting to consistently be able to run for at least 20 minutes - I still have a bit to go before I hit the 40-minute mark.

I’ve yet to attend a conference, but I am registered to attend the 2021 Libertarian Party of Ohio Conference next month.

And apparently, I only have one lesson left in the fast.ai course - I might as well watch the video to say I completed the course.

I’m close to maxing out the Chase Freedom Flex grocery bonus - at 82% of the first year complete, I’ve spent 82% necessary to max the bonus.

The Goals We’re Making

- Max out our Roth IRAs & HSA

- Max the match on our 401ks

- Up our 529 contributions from $25 to $30 a month per kid

- Up our church donations from $50 to $100 a month

- Figure out what to do after debt

- Read at least one book to each kid every day

- Hike as a family at least once a week (typically on the weekend)

- Sign up our son for preschool

- Potty train son

- Enjoy our daughter learning to walk and talk

- Max two hours of TV for the kids only on the weekends. No TV during the week.

- Have at least seven dates

- Maintain my weight at 225 lbs or less

- Run at least one 5k

- Continue strength training

- Run for city council

- Read (i.e. finish) one book per month

- Remove the jQuery dependencies on my blog

- Clean up my blog’s CSS

- Continue with the Blog Statistics, Book Reading List, and End of Year Side Income Report series

As far as figuring out what to do with our money after debt, we’ve both increased our 401k contributes to put at least the $19,500 max into each. In fact, we’ll both be able to put more than the max - both accounts have the same verbiage:

If your pre-tax and Roth 401(k) contributions to the Plan reach the maximum amount permitted by law, the Plan will redirect your pre-tax and Roth 401(k) contribution rates to an after-tax savings contribution rate. This will allow company matching contributions to continue until the maximum combined contribution limit is reached. Your pre-tax and Roth 401(k) contribution rates will change when you elect a different rate, or a new plan year begins.

I’m also - carefully - maxing out my solo 401k. I say carefully because the most I can put it is 20% - if I decide to expense something, that will lower what 20% means.

I’ve not only run one 5k, I’ve run three and plan on running more. The three I’ve run so far are, with times:

- Vandalia 5k (2021) on May 12th - time 35::36.2

- Hobart Urban Nature Preserve 5k on June 13th - time 42:47.5 7/11/2021

- Lost Creek Reserve 5k on July 11th - time 36:37.2

That’s it for now. How are your goals going?

Leave a Reply